Personal liability insurance is an essential policy that can protect you against financial losses in the event of an accident or injury that occurs on your property. Many people overlook the importance of having personal liability insurance, but it can be an incredibly valuable investment that can offer peace of mind and protect your financial well-being. In this article, we’ll explore why you should have personal liability insurance, and why it’s important to have it when you call contractors to do repairs on your home.

What is Personal Liability Insurance?

Personal liability insurance is a type of insurance that protects you from financial losses if you are found liable for damages or injuries that occur on your property. This type of insurance typically covers a range of incidents, such as accidental injuries, property damage, and legal fees related to the incident.

Why You Need Personal Liability Insurance

There are several reasons why you should have personal liability insurance. Here are some of the most important:

Protection for Visitors

One important reason to get personal liability insurance is out of concern for the safety of others on your property. When you have this type of insurance in place, you demonstrate that you are taking proactive steps to protect the well-being of anyone who visits your home or property. Personal liability insurance provides financial protection for guests, family members, and other individuals who might be injured or suffer damages while on your property. This can give you peace of mind knowing that you are doing everything possible to ensure the financial well-being of those around you.

Protection Against Lawsuits

If someone is injured on your property or if you accidentally damage someone else’s property, you could be held liable for the damages. If you don’t have personal liability insurance, you could be on the hook for thousands of dollars in medical bills, legal fees, and other expenses.

Protection for Your Assets

If you are found liable for damages or injuries and you don’t have personal liability insurance, your assets could be at risk. Personal liability insurance can help protect your assets and ensure that you’re not left financially devastated as a result of an accident or injury.

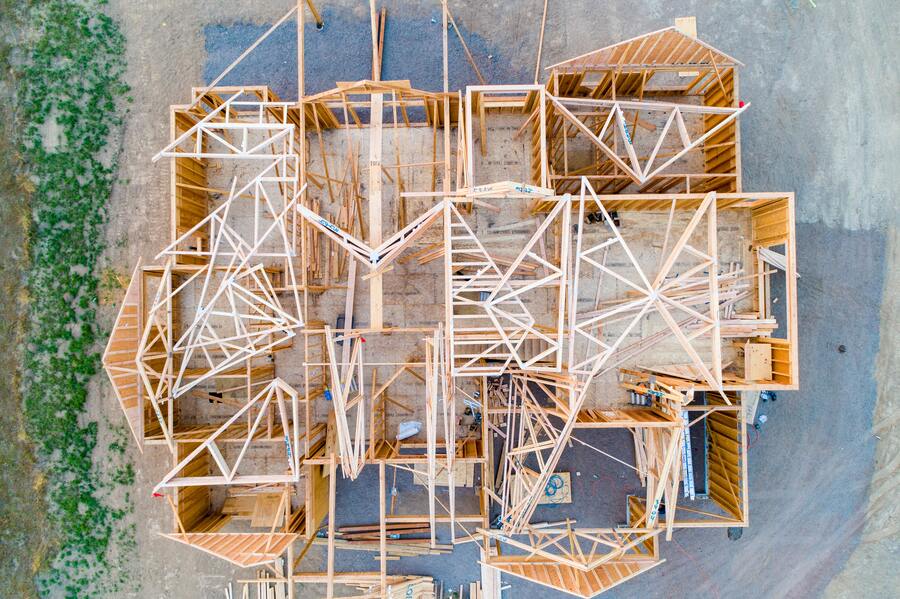

Why Personal Liability Insurance is Important When Calling Contractors

If you’re planning on calling contractors to do repairs on your home, it’s important to have personal liability insurance in place. Here’s why:

Protection Against Accidents

When contractors are working on your property, accidents can happen. If a contractor is injured on your property, you could be held liable for their medical bills and other expenses. Personal liability insurance can help protect you from financial losses in the event of an accident.

Requirement by Contractors

Many contractors require their clients to have personal liability insurance in place before they start work. This is because they want to ensure that they’re not held liable for accidents or injuries that occur on the property while they’re working on it. Having personal liability insurance in place can make it easier to find a contractor who is willing to work with you.

Personal liability insurance is an important policy that can protect you from financial losses in the event of an accident or injury on your property. It’s particularly important when you’re calling contractors to do repairs on your home, as accidents and damage can easily occur during these types of projects. By investing in personal liability insurance, you can enjoy peace of mind knowing that you’re protected and by taking proactive steps to protect your financial well-being.

Whether you’re a homeowner or a renter, having personal liability insurance can offer you the peace of mind you need to feel confident in your everyday life. So, don’t overlook the importance of this valuable policy – make sure you have personal liability insurance in place to protect yourself and your assets.